Whitehorse Real Estate Investment Strategies.

#1: Collect Rent

Also referred to as Buy and Hold or ‘riding the market’, this simple form of investing entails holding on to your cash flow positive rental property, and when you cash out, you will have made the natural increase in market value.

Strategy- Long term, lower risk, very hands-off - Perfect for investors who see Whitehorse for its long term growth potential, global appeal and shortage of rental property.

Attainable for those who are comfortable using leverage or have down payment cash saved up.

Leverage: Invest 100k on a 500k investment property, the market increases 5%, and your initial investment gains a 25% increase, 100K turns into $125k in 12 months.

#2 Quick Flip

Modern Clean and Move-in ready - In a robust real estate market, simple improvements to a property can allow you to buy and sell in a few weeks with impressive gains. Buyers often don’t have the time, money or skill, to do renovations. Flippers capitalize on the willingness of buyers to pay for super cute homes.

Strategy - Short Term. Perfect for the visionary hands-on investor, able to multitask, stick to a budget and manage stress.

Budget - 20% of the purchase price plus improvements and holding costs.

#3: Buy Strategically

Future Condo Development - Buy a property that is most likely to be rezoned for increased density. This is speculative, banking on population growth and increased demand for affordable housing.

Strategy - Long Term. You must be patient, confident and able to keep your cool through the land assembly or rezoning process. You may need to help the property owners around the parcel to understand the benefits of the proposed rezoning.

#4 Buy the Building Without Buying the Building

This investment is mostly hands-off and is less expensive than you think. This might seem confusing, but I have a rock-solid strategy, interested? Call me.

Strategy - Long term, you must be aggressive, determined and able to buy with short notice.

#5 Leverage

With dedication to this acquisition strategy, you can acquire multiple rental properties. It’s exhilarating! As the market value of your investment property increases, you can pull 80% of the equity out to purchase another investment property. Utilizing this strategy is how you can build a real estate portfolio. It’s all about making the numbers work with the right lender. I can help you find the lender and the perfect cash flow positive rental property in Whitehorse.

Strategy- Long Term. Persistently choosing excellent investments to hold through the ups and downs of the market. Leverage is for the aggressive investor who loves wheeling and dealing and squeezing equity out of their real estate holdings. The leverage strategy is highly dependent on your debt service ratio and cash reserves.

#6 Restructure

You are rescuing a property owner from bankruptcy. The bank is about to foreclose. In essence, this is a buy and sell. You buy out the owner below market value and sell for a premium in the future.

Strategy - Quick Flip, Ready to Act Fast This is for the patient investor who can wait for the right property to become available and act quickly — low stress, statistically based, medium risk.

WHY INVEST IN WHITEHORSE?

Global Perspective

Local Perspective

Step 1:

Call or text Scott: 867.333.1095

Step 2:

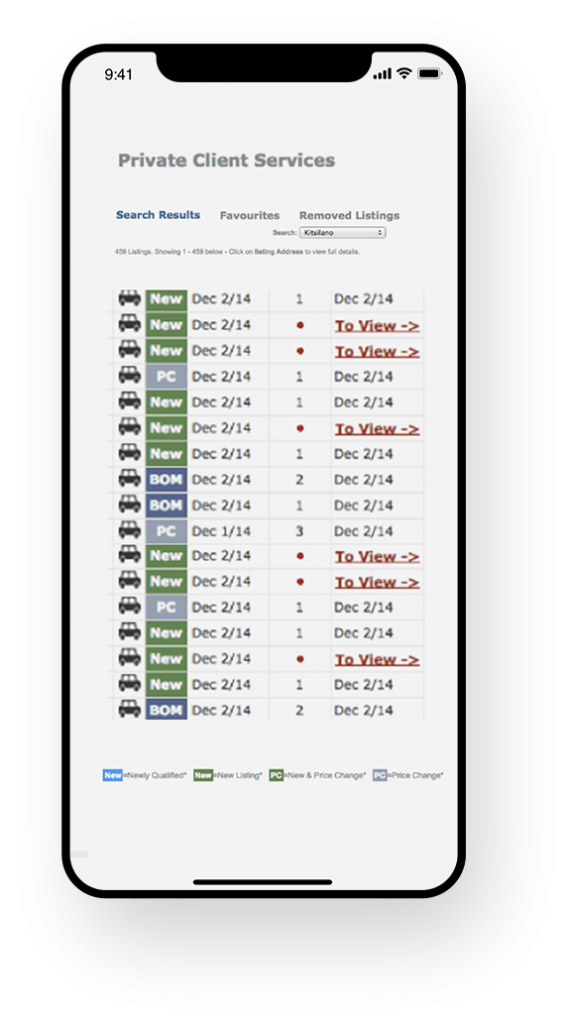

Assessing Investment Strategies

Six ways to get what you want out of the Whitehorse real estate market

Each option has a different level of risk and investor involvement. Use my analytical and strategic thinking to your advantage. Let’s discuss your options and determine how I can help you achieve your goals.

Step 3:

Establishing Your Buying Power

The right bank and banker will make all the difference; some are very slow, invasive and difficult. I will help you find the right lender for your situation.

Pro Tip – Get Preapproved – With approved financing; you can scoop up a big juicy deal before other buyers have a chance!

Step 4:

Options are good

Step 5:

Preparing to Buy

Step 6:

Executing the Plan

Step 7:

Annual Evaluation

Once a year, I will send you a synopsis of how your investment is performing. We will have a meeting and evaluate if it’s time for you to cash out, buy another or diversify. If you prefer, I can email you this report.

- A Market Value Update

- Neighbourhood Review

- Repairs and Maintenance

- My Insights

Step 8:

Exit Strategy

Before starting an investment, it is wise to have an exit strategy so that you can exit the market with the highest returns. We will discuss time frames so that you can read the market and exit at the peak, thus liquidating your investments strategically instead of reactive and rushed.

Influencing factors:

- Consider equity financing

- Tax planning

- Repairs and maintenance cycles