First Time Buyer

This was our first time buying a home. We did a lot of research on our own and even bought a book full of home-buying tips.

The Whitehorse Real Estate Market Is Fast-Paced & Can Be Tricky.

Keep Reading Scott’s First-Time Buyer’s Guide -Tips and Tricks.

This was our first time buying a home. We did a lot of research on our own and even bought a book full of home-buying tips.

Let’s use the example of a brand new home in Whistlebend, asking $500,000. The minimum downpayment is 5% $25,000. Now that you are the owner, the value goes up with the market. If the real estate market goes up 5% in one year, your home is worth $525,000 plus you have paid down your mortgage, building equity. Had you not bought the house one year ago, you would have needed to save an additional $25,000 over 12 months to be able to replicate the financial benefits of being in the market today.

Isn’t the market maxed out? Won’t prices go down soon?

No – there are lots of affordable options for buyers and the real estate market in Whitehorse has lots of growth potential.

What if I want to travel?

Fact – Most homes rent for more money than your mortgage payment, you can actually make money while traveling!

I will help you buy a place you can easily rent out, so you can be free to travel and work abroad.

If you have saved 2.5% of the purchase price, Yukon Housing can lend you the balance. (subject to availability)

Be sure to contemplate if you want to access some great home buying programs available from Yukon Housing. They could lend you ½ your downpayment. Downpayment Assistance from Yukon Housing, your home must meet specific requirements to qualify Modest Design Guidelines.

Buy a home with a 5% downpayment, keep the purchase price under $500,000.

If your purchase price is between $500,001 and $999,999, there is a ‘staggered down payment system’ where your down payment is 5% of the first $500,000 and 10% of the remaining purchase price.

$400,000 purchase price.

$600,000 purchase price

Mortgage tip: If you are buying with less than a 20% downpayment, you will need CMHC mortgage insurance, its just part of what your bank will do for you.

Access the 25K down payment you didn’t know you could get!

If you don’t have enough savings to put a downpayment together, this is one creative idea to make it happen.

You can get an RRSP loan to buy a $35,000 RRSP and 90 days later withdraw the funds and use them for your down payment. The beauty of this is that you save the income tax on the $35,000. If your income tax bracket is 29% federal and 9% Territorial, you now have $34,500 to use towards your down payment. The additional $9,500 are your tax savings.

For details see Canada Revenue Agency.

Mortgage calculators are fun to play with, but you will need to sit down with a professional to know your real budget.

I recommend Mark Huntley from RBC 867.334.6134 cell.

Beautiful homes sell fast, and some are listed and sold in one day. Not having your mortgage pre-approved is the #1 way to lose the home you love.

To get pre-approved, the bank will need to look at your notice of assessment, most recent pay stub letter of employment and financial history. The pre-approval process can take several days, plus you may need to wait for an appointment, and if they request additional documentation, there can be further delays. Imagine the only roadblock to owning the home you love is a simple financial document, extremely frustrating.

I can refer you to the right mortgage professional based on your situation.

The stress test is part of your pre-approval. It ensures that your current income can accommodate a 2% increase in your mortgage interest rate.

Changing your financial situation is risky. for instance

House Shopping the fun part!

Be the first to know about all the hot new listings in real-time. Sign up now to beat other buyers to the best listings.

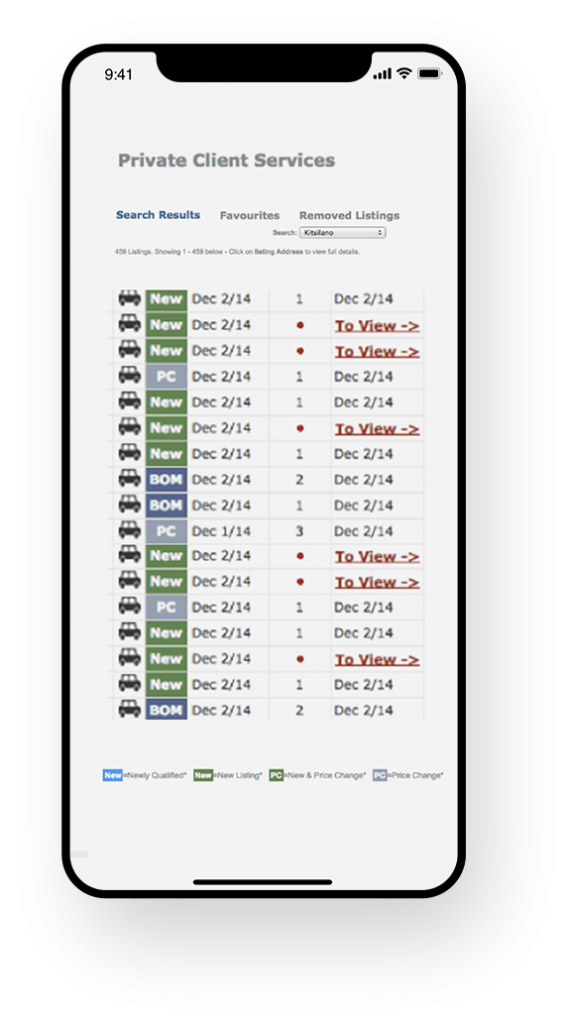

Share your wish list, and I will set you up on my real-time exclusive home finder notification system.

When a home catches your eye, call me immediately. Great listings sell fast, even if the sign is not from RE/MAX I will show you the home and help you buy it. Use my experience to your advantage.

How Do I Get Paid?

I only receive a pay cheque if you successfully buy a home with my help. Every home for sale has renumeration offered to the realtor who assists the purchaser. This fee is traditionally fixed but sometimes it needs to be negotiated as part of the purchase price or paid separately from the purchase.

If you are nervous about accidentally buying a property that needs unforeseen repairs. I will make sure this doesn’t happen to you by recommending that you have the property professionally inspected.

Before you make an offer or pay for an inspection, we will review the building permit history and any disclosures so that you have a good understanding of the building’s history.

Free hand sanitizer and disposable gloves

Electronic Contracts

E-Signatures Avaliable

Virtual Showings

Showings with Social Distancing

Offers Presented Remotely